Necessity is the mother of all inventions! We’ve all heard of this English proverb over and over again. When the grazing grounds for horses that pull carriages in England were in short supply, the steam engine was invented. The cotton gin that allowed for mechanical processing of cotton from the US south was developed because of labour shortages. The Manhattan Project, the erstwhile ARPANET (internet), Telecommunications, the overarching society in itself, and even belief-systems such as religion, it can be argued, were all borne out of the necessities of those times.

Distributed Ledger Technologies such as Blockchain was also envisioned as a solution to the necessities of the modern age. It was created out of the need of eradicating the middlemen, removing the human agency from business and giving the power to mathematical algorithms for settlements.

Imagine Blockchain like a never-ending chain of virtual blocks in which data is stored. This chain of blocks is immutable, meaning once the data is stored, it cannot be altered without the requisite privileges allows for absolute data provenance, meaning all of it can be traced and cannot be changed. It’s immutable, and this is one of the most significant value points for Blockchain in Banking.

Disruptions in Banking

Globally, the banking industry amounts to 134 Trillion Dollars, and blockchain technology has the potential to disrupt this massive industry in the following banking service sectors.

Identity Management:

The technology of digital blocks linked with one another can be used for creating a client identification system of a decentralized nature. Present-day’ centralized’ databases are incredibly vulnerable to personal identity data hacks and leaks. Every bank operational today needs to perform a KYC, or Know Your Customer before processing any applications. Blockchain easily overcomes all these regulations and shortcomings.

Creating an identity on Blockchain empowers the user with greater control over the access and privilege rights of their personal information. The particular manner in which blockchain functions, is, all the information will be stored in a secure location that would be accessible to everyone or specific people, based on the user’s requirements or preferences. This form of identity management is in direct contrast to social media platforms, like Twitter or Facebook usernames, which face the danger of being confiscated or censored at any time by the respective companies.

Clearance and Settlement Systems:

Blockchain can significantly minimize operational costs, while at the same time usher-in the possibility of transactions on a real-time basis between financial institutions. Banks traditionally take around three days on average to settle bank transfers. This is not just a painful logistical nightmare for the financial institution, but also a pain for the consumer. Furthermore, a simple bank transfer has to bypass a complex and complicated system of intermediaries before it reaches the destination. On the other hand, Blockchain, in theory, can facilitate faster payments, but a lot of research is still being done to achieve a commercial scale for this particular aspect.

Payments:

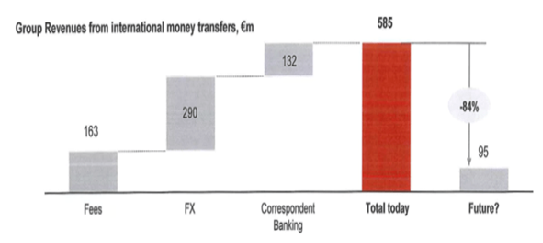

A typical cost per transaction for a money sender is around 7.68%, which is associated with per-transaction fees associated with wire fees or hidden exchange rates. Facilitating payments is highly profitable for banks. Cross-border transactions have generated 40% of global payments transactional revenues during 2016.

Blockchain in this payments domain can revolutionize the business. With every transaction recorded on a distributed digital ledger, there is discrepancies or conflicts at all. Moreover, as the payments are made with blockchain-based cryptocurrencies, they already cost lesser fees than traditional banking. It allows higher security with minimal costs to process the refund between organizations and their clients and even between banks.

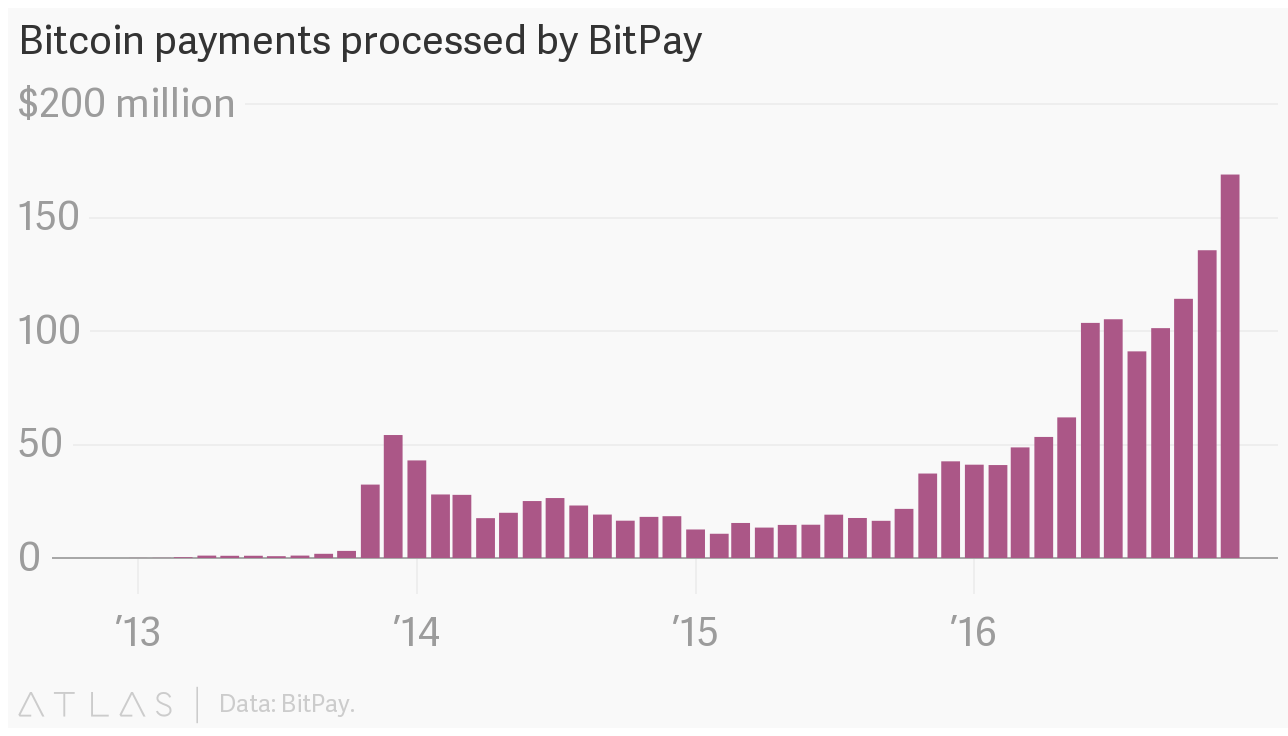

Over the last few years, BitPay, a payment processor for Bitcoin, has observed a sharp rise in transaction payment volume

Both the Merchants and the individuals can get benefited from the blockchain.

Less-expensive blockchain payment networks is a good option for merchants. It can provide merchants with certainty within a few minutes.

Individuals can also receive payments with confidence and they are easier and less expensive than bank products.

Both the Merchants and the individuals can get benefited from the Blockchain.

Less-expensive blockchain payment networks is a good option for merchants. It can provide merchants with certainty within a few minutes.

Individuals can also receive payments with confidence, and they are easier and less expensive than bank products.

Blockchain offers a higher-security and lower-cost way to send peer-to-peer (P2P) payments. Cryptocurrencies like Bitcoin and Ethereum are built around a public, decentralized ledger and used to send and receive money. In doing so, blockchain technology is now giving the people around the world access to fast, cheap, and borderless payments.

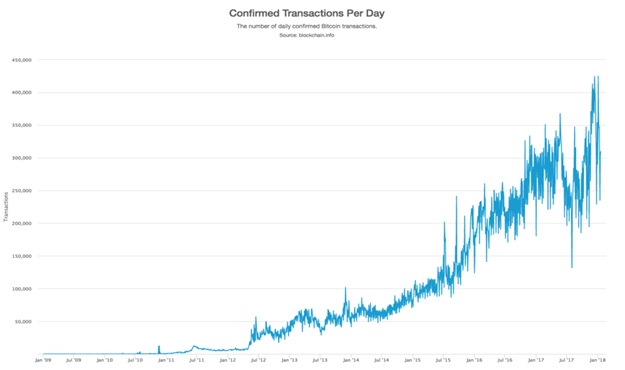

Bitcoin transactions per day have grown by 8x from around 50,000 of 2014 to more than 400,000 as of 2018

Loans and Credit:

Extremely safe and secure, Blockchain helps with easy qualification for loans. Since everything is bound with mathematical computations, this eliminates the requirement of the “gatekeepers” in the banking, loan, and credit industry. Lending on the Blockchain offers a cheaper, more efficient, and more secure way of making personal loans to a broader pool of consumers. You buy a company’s token to become a member of the network, and then put up some cryptocurrency holdings as collateral. That allows you to borrow money from lenders on the platform. Once you pay your loan back on time, you will get your crypto back.

The immutable “Smart Contracts” of Blockchain helps to create an accurate single version of data which provides transparency about collaterals. Blockchain increases the visibility of the available collaterals. Blockchain helps to reduce the engagement time of resources spent on a collateral settlement. Blockchain can help in eliminating manual errors and associated risks and can maintain confidence in the market.

Fundraising:

Blockchain is a truly universal and unbiased method for recording information, which is then utilized for fast-settlements and data provenance. The application of Blockchain in financial investments, such as bitcoin, has created and nurtured an innovative crypto-economic funding model. This revolutionary model for fundraising in the form of Initial Coin Offerings (ICO) allows businesses immediate and unmatched access to liquidity.

Trade Finance:

Trade finance is still mostly based on lots of papers, such as bills or letters, being sent by fax or post around the world.

Blockchain-based trade finance can help to streamline the entire trading process by getting rid of this time-consuming paperwork. It eliminates the need for several copies of the same documents and can integrate all necessary information in one place, which is updated in real-time and can be accessed by all network members.

Blockchain is the obvious solution as numerous parties need access to the same information. Being a vital element of the supply chain, and Blockchain can offer a vast amount of items in this area. By replacing the complicated paper bills of the lending process in the trade & finance industry, blockchain technology can create more clarity, security, and guarantee among trade parties world-wide.

Securities:

Blockchain is recognized for reducing fraud in the financial world. It has been found that 45% of financial intermediaries like stock exchanges and money transfer services are more prone to financial crimes. Blockchain has tokenized traditional securities like stocks, bonds, and alternative assets and placed them on public blockchains system and making it possible to create more efficient, interoperable capital markets.

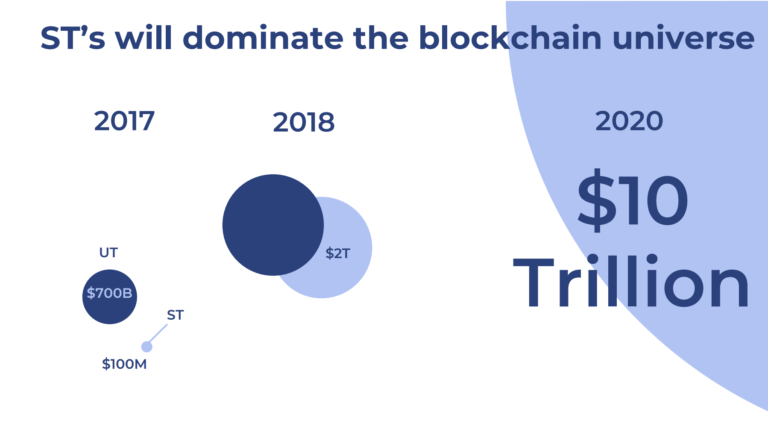

The slide above from Polymath predicts that the market for security tokens will grow to $10 trillion by 2020

Deposits and Withdrawals:

Interestingly, only a handful of people are aware of the exact workings of the modern banking system. Most of the people engaging with banks via deposits and withdrawals very rarely try to find out about how the bank works and what does it do with your money. In reality, the bank loans out most of the money deposited via their reserve banking. And only a fraction amount of the deposited money is held as reserves.

Now what happens generally, there is usually a vast panic when people want to withdraw their money, all at once. And naturally, banks are unable to satisfy this request as they only hold a small fraction of the total deposited amount. Enter blockchain and traditional banks will not be able to find alternative solutions to when the panic arises because the Blockchain is ultimately a ledger representing all accounting entries.

Beyond this promotion

Banking Disruption cannot happen overnight. Blockchain technology though is in its outset; still, the transformations cryptocurrency has done till now makes us believe that it can replace the bank’s paperwork and many more daily cumbersome works. However, even if it thought that the blockchain technology could supplement traditional financial infrastructure and make it more efficient, one thing is pretty clear, that: Blockchain is a highly required technical paradigm shift to transform the banking industry.